- Why the traditional talent ecosystem has broken.

- How the business case adds up for offshore accountancy talent.

- Understand how the numbers for offshore accountancy talent add up for your business.

- Checklist: Is adding offshore accountancy talent right for your business?

- Get started, find talent, learn more.

‘’Our business benefits from significant productivity gains vs. hiring in-country.’’ – Russell Khan, Head of People and Culture, OneStop (Yempo client)

We’ve ‘entered a new sourcing ecosystem’ (Deloitte) The traditional accountancy talent ecosystem has broken

Do you struggle to recruit and keep the accountancy talent that your business needs? Yes? Then here’s the good news:

You’re in the majority!

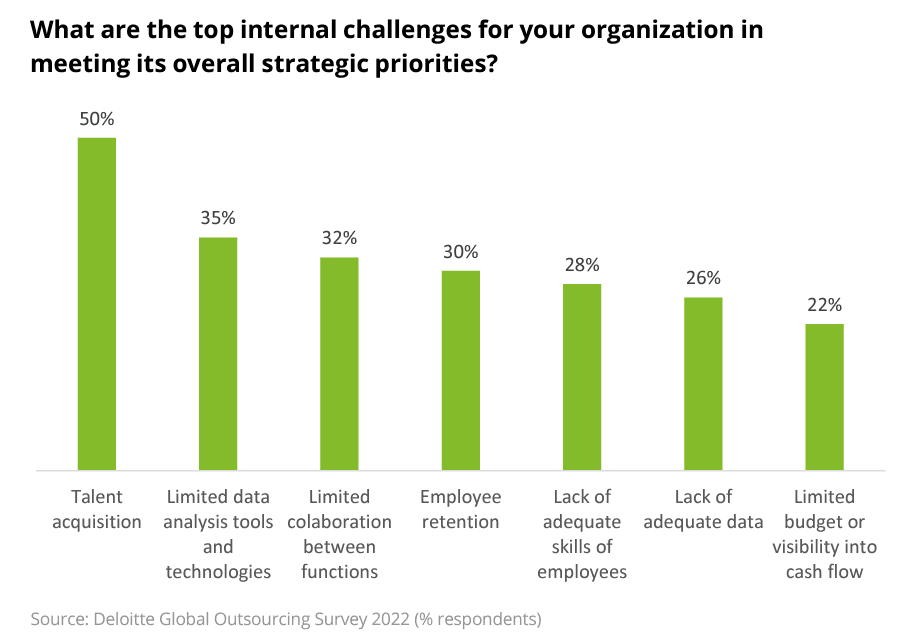

Deloitte’s research found talent acquisition is the top internal challenge for organisations. Plus, 62% of executives say they are ill-prepared to address the causes and impacts of poor employee retention.

In just a few short pandemic-accelerated years remote working has opened a deeper, wider, job pool. Accountancy talent has dived in.

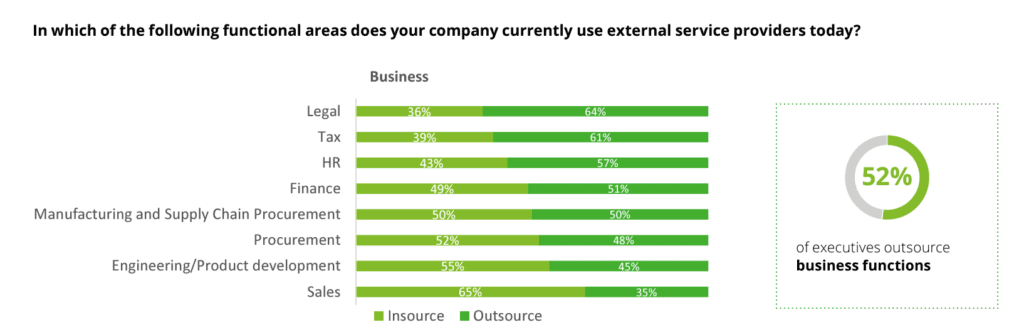

Response: 51% of businesses use outsourced finance functions

In 2024, adding outsourced accountancy talent to your team is business as usual. So, what are the key benefits? And what are the business risks associated with continuing to only hire in-country?

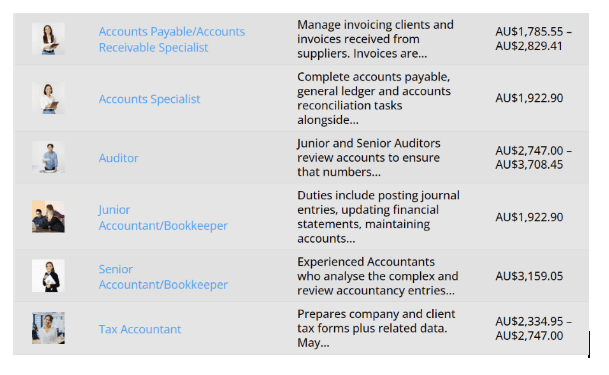

1. Philippines accountancy salaries are 70% lower

What would your firm’s salary numbers look like?

Over the next few pages, we outline five key business benefits that outsourcing financial and accounting services brings. These are sample numbers based on what outsourcing clients achieve. So, grab a piece of paper to work out likely benefits for your own business.

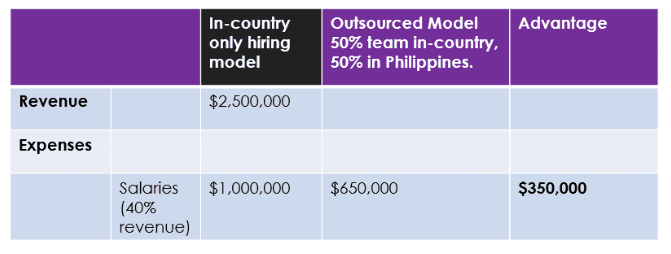

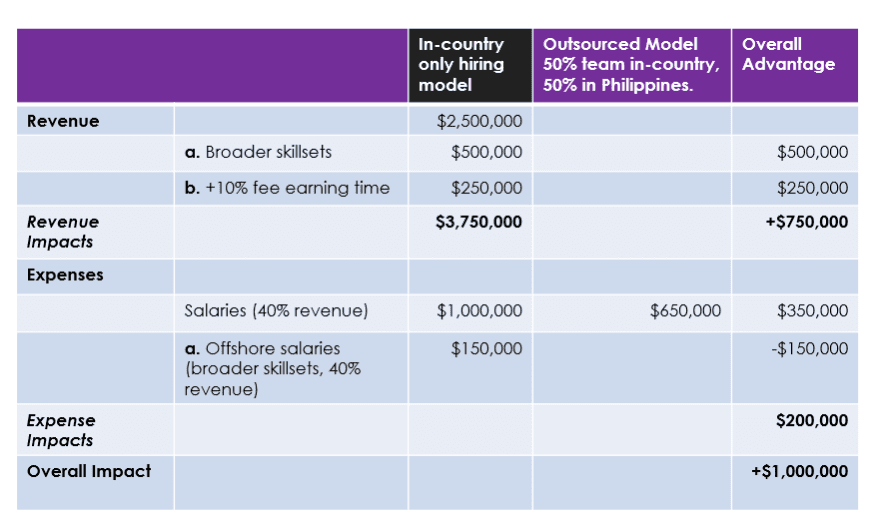

In this example, an accountancy business spends 40% of its revenue on salaries.

Let’s assume that 50% of this salary spend supports the company’s senior in-country leadership team, 50% supports middle and junior roles. 50% of salaries = £500,000 ($1,000,000 / 2).

If the middle and junior roles supported by 50% of salaries are filled by Philippines-based Accountancy talent, then this delivers a 70% salary saving for these roles = $350,000 ($500,000*0.7).

Any loss of control? No. Yempo’s model means that the accountancy talent you select is a fully dedicated part of your team.

‘’Incoming calls to our Perth number are answered by anyone in our team – Australia and Philippines – and customers can’t tell the difference.’’ – Andrea Harris, CFO, (Yempo client)

2. Specialised skill sets, more revenue opportunities

What accountancy skills would you add and offer?

Do you leave revenue opportunities on the table because of a lack of suitable and/or affordable skills?

Deloitte’s research found that 28% of firms report a lack of adequate skills of employees. This leaves toeholds for competitors to gain access to your clients.

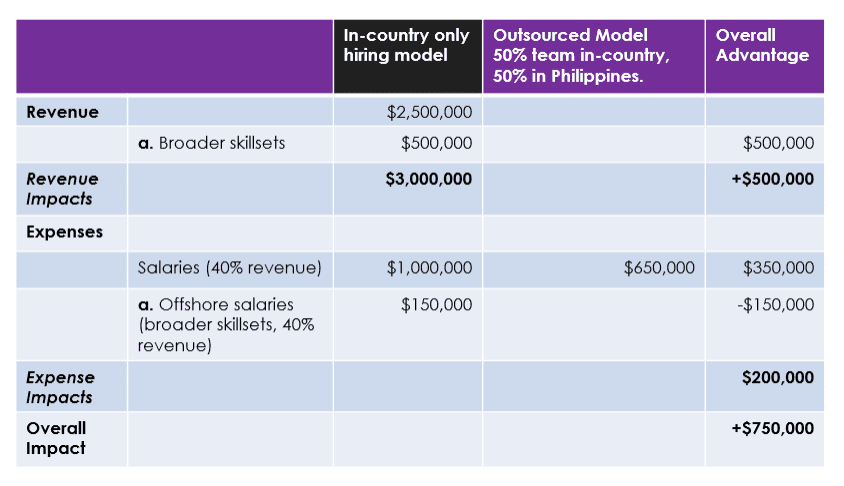

The broad range of skills and lower costs of Philippines talent make it possible for accountancy businesses to maintain margins on work that in-country teams cannot profitably service. Refer to point a. in the table below.

‘Yempo gives us access to a cost-effective pool of high-quality candidates; plus, great advice.’’ – Kirsten Forrester, CEO, Accounting for Good (Yempo client)

3. Senior experts are freed to focus on growth

How would your firm use this capacity?

How much of your senior team’s time is sunk fixing talent issues rather than winning and delivering fee earning work?

Senior partners at accountancy firms tell us that local talent is in extremely short supply. Salary and staff turnover rates are climbing.

It’s very frustrating for them.

By filling talent gaps with offshore talent, they freed themselves to grow their businesses. Refer to point b. in the table below.

‘Yempo gives us peace of mind. A one stop shop from job spec to ad, interview, employment, admin, tech, payroll.’’ – Simon Joyce, Director, SDJA Audit Specialists (Yempo client)

4. More funds to accelerate growth

What business opportunities would you pursue?

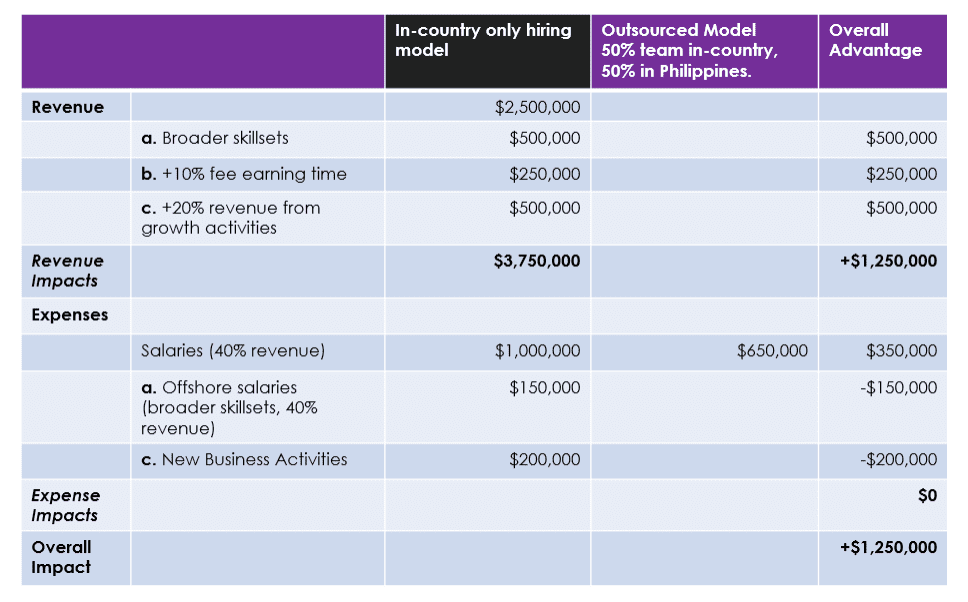

Funding marketing and new business activities, plus adding not yet fully chargeable talent to your team, can be cost-prohibitive.

Adding more chargeable talent may be unaffordable until full utilisation is guaranteed.

Growth is slowed.

In this example, we’ve reallocated $200,000 from the $350,000 saved by outsourcing 50% of the salary bill to New Business Activities.

Growth is accelerated. Refer to point c. in the table below.

5. Lower technology costs, reduced security risk

How would these affect your business plans?

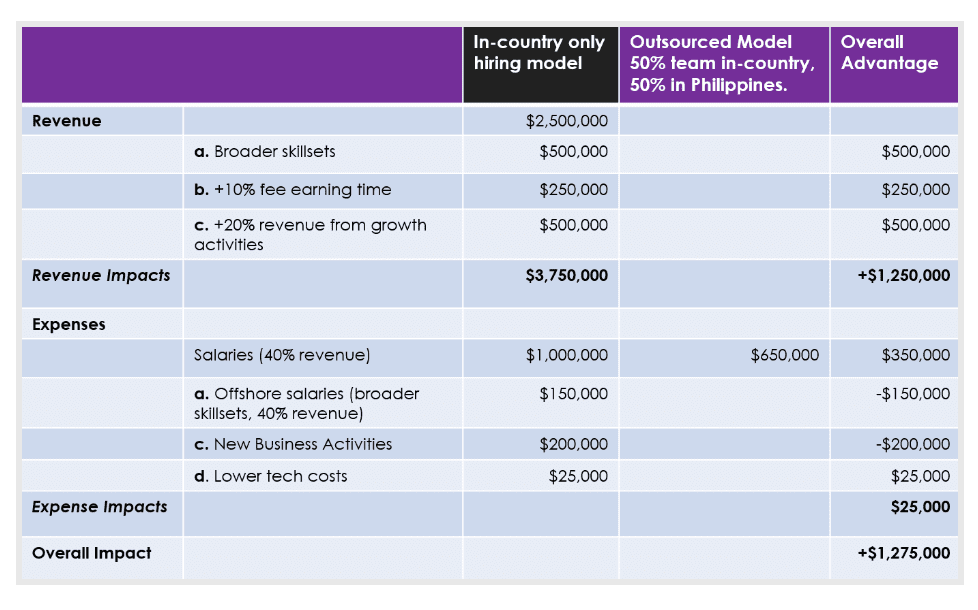

Accountants are experts in accountancy. They are not experts in the provision and management of enabling technology and cyber security.

Technology & cyber are necessary evils.

Accountancy outsourcers are experts in the provision of enabling technology and cyber security. It’s core to their operations. These costs are wrapped into the simple, monthly fee that Yempo charges for each person.

Your savings & productivity gains may be larger than we’ve allowed in this example. Refer to point d. in the table below.

Understand how the offshore accountancy talent numbers add up for your business.

Click here and select your currency.

Select the accountancy skillsets you use.

Compare costs vs. local hires…year one, over three years.

- You’ll measure the potential for salary savings.

- You can see the costs of adding new skill sets, funded from salary savings.

- You’ll start to understand how much senior time can be freed.

- You can plan how savings fund growth activities.

- You’ll see how tech costs & headaches are removed.

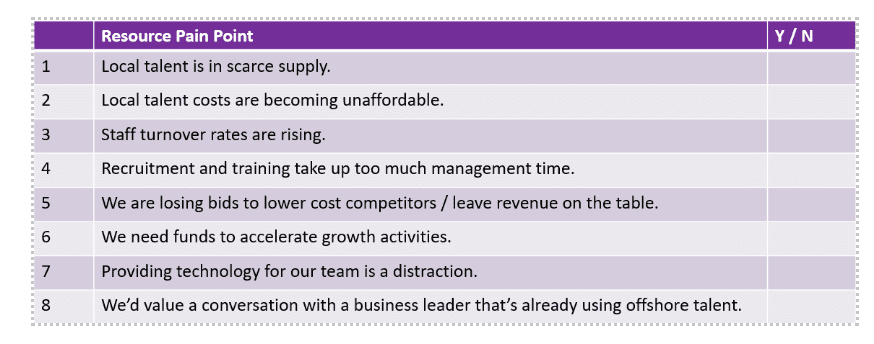

Checklist

Is adding offshore accountancy talent right for your business? If you answer ‘Y’ to more than three questions, then let’s chat.

Thank you for visiting our blog! We hope you found our content informative and engaging. Stay connected with us for more insightful blogs, updates, and tips on outsourcing IT & outsourcing Finance in the Philippines, or shoot us an email at [email protected]. We are happy to answer your questions!

Learn more

Find & cost the Accountancy talent you need.

Explore your aims with Michelle, our CEO.