You’d like to grow your accountancy business? Or perhaps you’re running another kind of business, but resourcing finance and accountancy takes up too much of your time and budget?

Our definitive guide explains how outsourcing your accountancy needs to the Philippines frees up capacity for growth, reduces process friction and is highly cost effective. You’ll know how to assess potential outsourcing partner(s) and select the right staff for your organisation.

Why outsource Finance and Accounting activities?

In Australia and New Zealand’s skills-short market, finding the perfect accounting candidate is challenging, so employers are willing to hire on potential to grow into a role and support training and professional development (Source: ACCA, Feb ’23)

You’d like to take advantage of demand in your local market. But the inevitable downside of good times in the sector is a shortage of skills. “Access to Australian talent is in very short supply” explains Kirsten Forrester, CEO of Yempo client, ‘Accounting for Good’.

According to Hays, in 2023, the most in-demand accounting skills in Australia and New Zealand are:

AUSTRALIA

NEW ZEALAND

1. Financial Analysts

2. Finance Managers

3. Payroll

4. Assistant Accountants

5. Accounts Officers (including AP/AR Officers)

1. Payroll Officers & Managers

2. Senior Financial Accountants

3. Commercial Analysts

4. Finance Business Partners

5. Senior Management

6. Accountants

The result? “77% of employers in Australia and 83% in New Zealand said they have offered higher salaries than they’d originally planned”, reports the ACCA.

You may also be experiencing high staff turnover as your finance and accounting team members are regularly approached by competitors, wooing them with offers of higher salaries.

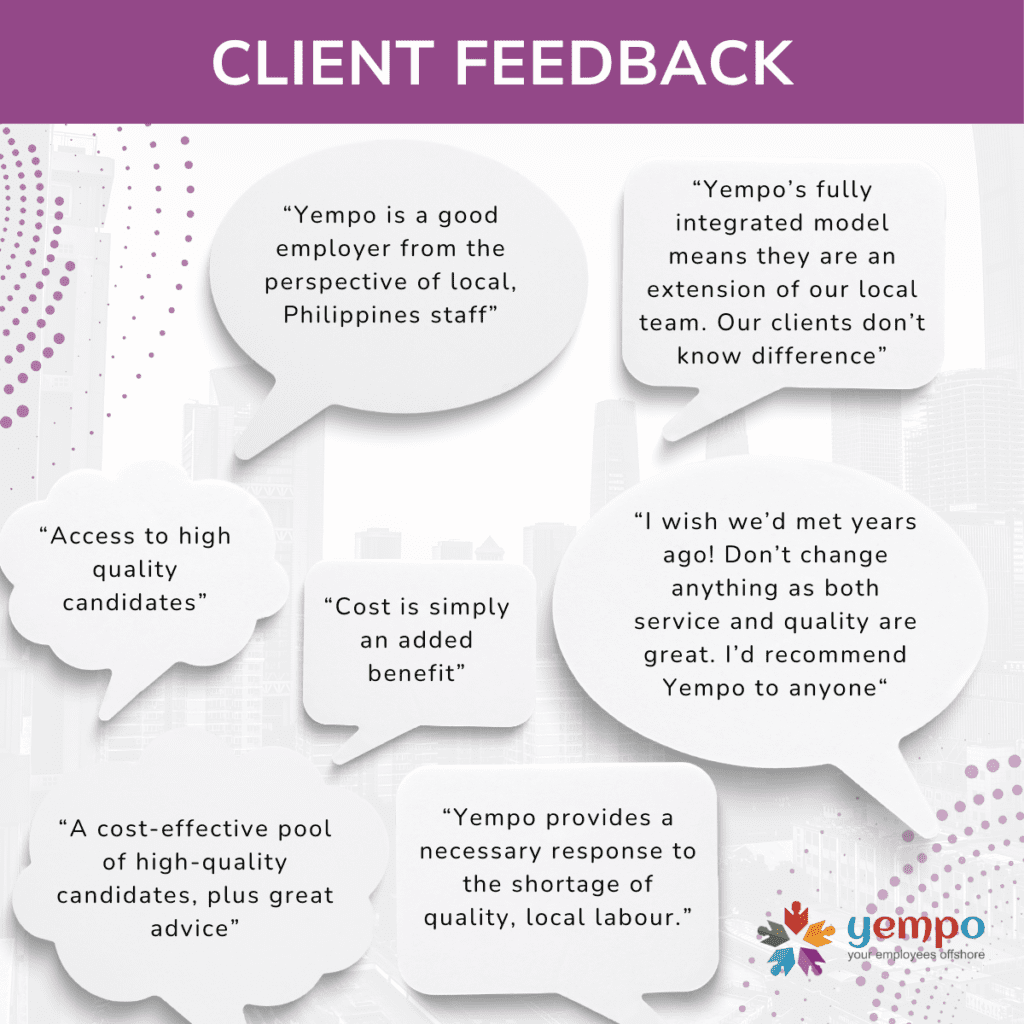

We asked an independent research partner to interview our accountancy and finance clients to find out how their businesses are addressing these challenges by building offshore teams in the Philippines.

In addition, they reported that they can:

- Overcome local labour shortages…and continue to grow their businesses.

- Reduce employee turnover…less management time training new employees.

- Free up leadership time for higher value tasks…focus on growth, not processes.

- Reduced costs by up to 70% (vs. local hires) … improved margin and profit.

- Build one global team…English skills, culture and time zones play well for them.

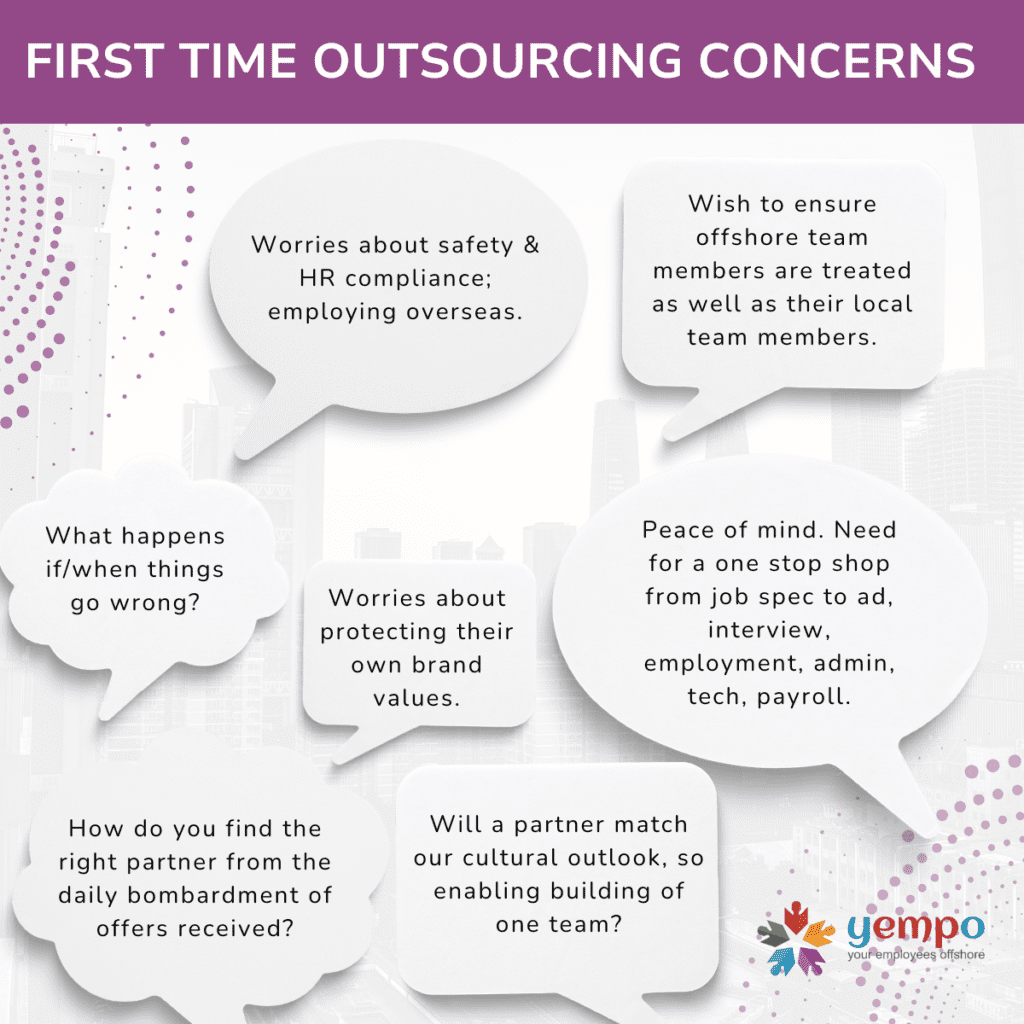

Why doesn’t everyone outsource accountancy & finance?

Accountancy and other organisations that don’t take advantage of outsourcing face real, significant, competitive disadvantages vs. those that do. So, what are worries that get in the way?

We asked our research partner to investigate. This is what our accountancy and finance clients said were their biggest concerns about adopting an outsourced, offshore, model. All very fair challenges, we think you’ll agree.

We’ve outlined the steps to follow to select the right finance and accountancy outsourcing partner for your organisation. Access the vast array of benefits that working with the right offshore partner can bring to your organisation.

Step 1 – How to find accountancy and finance specialist outsourcers for your initial ‘long list’.

Pro tip: Many outsourcers started as call centres rather than specialists providing professional services. Typically, these organisations don’t have access to the most experienced and/or senior resources and have a culture that struggles to retain top talent. So, if a provider appears to offer all manner of skill sets (admin, recruitment, engineering, healthcare etc.). They’re probably not going to meet your expectations.

The best place to start is by asking around your industry for recommendations and referrals. If this isn’t an option for you, then it’s time for Google. Aim for 5-7 providers on your long list.

Need a shortcut? We’ll happily set you up for a chat with some of our clients.

Key considerations: Only list providers where time zones and language skills are a likely match for your organisation’s needs. For example, if you’re running an accountancy business and need extra client-facing resources, then you need a compatible time zone or a location where 24×7 services are the norm. A great example of a match is Australia and the Philippines. As one of our clients told our researcher, “Excellent English and shared time zones make working with our Philippines-based team very easy”.

Step 2 – Create a shortlist by finding accountancy outsourcers that match your business culture.

Pro tip:

- List what it is about your business that YOUR clients value.

- Identify a shortlist of 3 potential partners that match what you and your clients value.

Your clients work with you because you help them hit their objectives. If you’re to find the right offshore partner for you, then you need a match for the things that your clients value. Our advice? Spend a few hours on the phone asking your clients these four simple questions:

- What are the key features about your organisation that they value?

- What are the key benefits that your organisation gives them?

- What would they say makes your organisation distinctive vs. competitors?

- Ask them to sell your organisation to you in 30 seconds.

You’ll learn what your clients REALLY value. what you think matters. You’ll understand your company culture like never before (and have lovely new client quotes for your marketing!). Then, ask your long list of potential outsourcing partners these same four questions.

Compare what your clients value vs. what potential partners have told you. Do they match? Yes? Fab. No? Cut from your long list.

“I met with other accountancy outsourcers and was not comfortable with the way they treat their staff. Michelle knows everyone by name and her staff warmly greet her. Yempo treats people well so there is a ‘fit’ with our business.” (Yempo client)

Key Considerations: Michelle, Yempo’s CEO, key things to look for in potential partners:

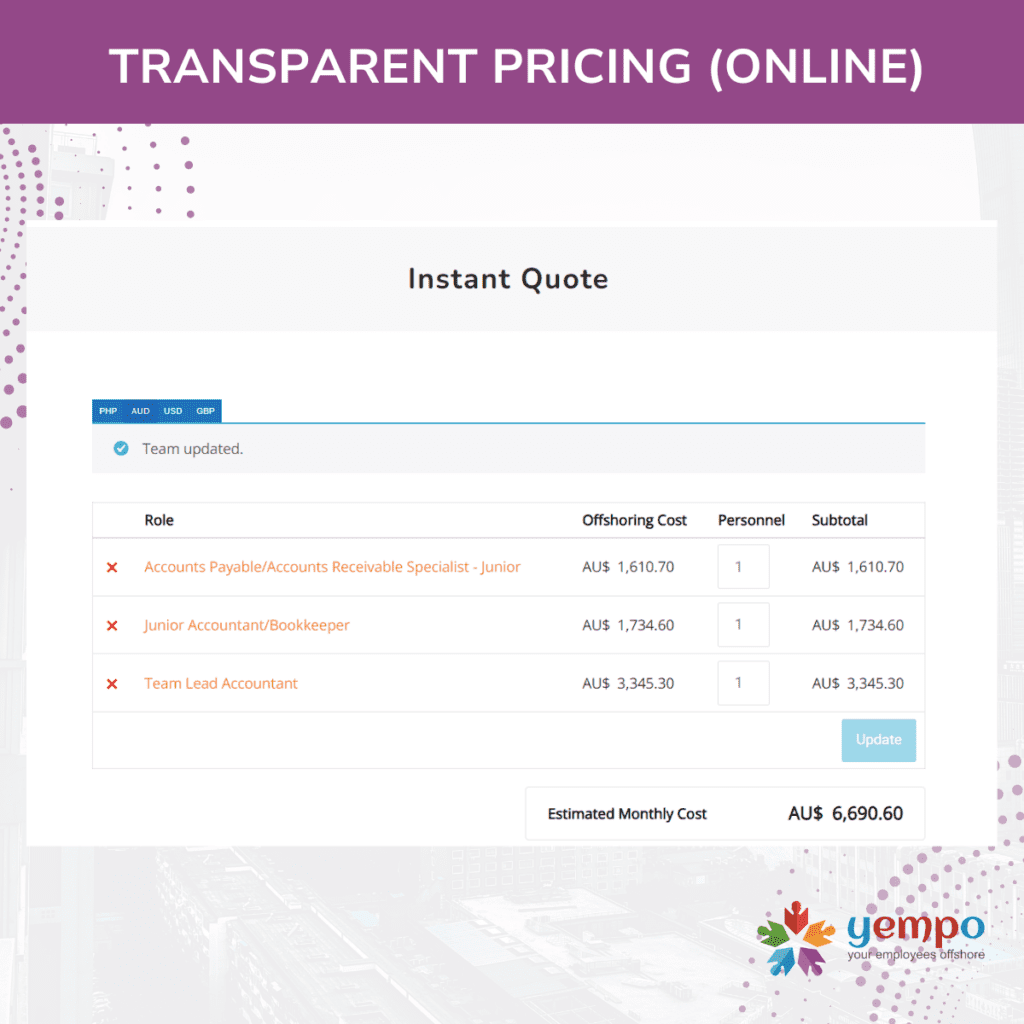

Step 3 – Dig into short-listed providers’ financial and operating models to avoid surprises.

Pro tip: ‘End-to-end’ outsourcing services and ‘all-inclusive outsourcing solutions’ mean different things to different people. Understand fees, how staff are selected & allocated to clients, technology provision, and management processes (particularly escalation routes to address any issues).

Key considerations:

Pricing should be transparent. For example, Yempo clients know what staff get paid and how much Yempo charges as an administration fee. Most other providers will say they have a similarly transparent model. Reality? There’s often a hidden list of ‘budget airline type’ extras. We’ve seen other operators hit their clients with recruitment fees, charge for meeting rooms, and charge for events and activities. It’s a long list. Avoid it.

Ask about staff turnover. We think you’ll agree that constantly having to recruit and embed new staff members into your team isn’t progress, especially for smaller organisations. Yempo’s employees typically stay for more than 5 years. Why? Fair pay and great working conditions. If the bottom price is your key metric, then you’re not going to get employee loyalty.

“As a small business, we can’t afford high churn rates. People like working for Yempo, so when they join, they stay” (Yempo client)

Your team members or their staff? Some accountancy and finance outsourcers rotate staff, which causes chaos for clients. Others have a ‘bench’ type offering where they match client demand and bench skillsets; often leaving clients with resource gaps. A key Yempo difference is that clients are involved in the recruitment process (with our guidance), selecting staff they want that then only work for them. This means that they can build effective relationships and working practices across their in-country and out-of-country teams.

“Yempo recruits for us based on our projected demand. Others have a ‘bench’ type talent arrangement that means they cannot always meet demand” (Yempo client).

Is Technology (hardware and software) up to scratch? Working across countries requires great tech and internet connectivity. Do make sure that short-listed providers will commit to providing the same level of tech that your in-country employees enjoy. It’s a well-worth up-front specification to ensure that your in-country and out-of-country teams can operate as equals.

Ask which finance and accounting packages potential outsourcing providers are familiar with. Are these the same as those your team regularly uses? Common accountancy software packages used by Yempo’s clients (and their Yempo teams) include SAP, Xero, Netsuite, Dynamics 365, and Quickbooks.

Michelle is an Aussie living and working in the Philippines.

“Yempo really does give you your own quality employees. You select and work with them whilst Michelle and team manage everything else – HR, contracts, IT, recruitment” (Yempo client)

Check Data security measures meet standards. No-one wants the brand damage and legal consequences of a data breach. It’s well worth asking your IT and Data Security team / manager to note down your data security expectations. Do potential accountancy and finance outsourcing partners have sufficient data security provision in place? While this is unlikely to be a problem (it’s a business basic for outsourcers) it’s well worth checking out.

HR Management Processes. Peace of mind that local HR legislation is understood and complied with is the number one concern of our clients. Ask prospective outsourcing partners about their HR processes. Do they have local HR experts working for them? What stages of the employee lifecycle are covered? Will they help you write job descriptions? With candidate interviews? How do contracts work?

Yempo’s HR Director is Riza Tendero, a local HR expert with decades of outsourcing expertise.

“We have a lot of experience with outsourcing, and Yempo is the first company we’ve found where delivery exceeds what we expected. Interviewing, contracting, hitting dates, invoicing…it’s all been so easy that we thought there must be a catch!” (Yempo client)

Step 4 – Take references

Pro tip: request to speak to at least three current accountancy outsourcing clients. Ask them the same four questions that you used in step 2 (albeit as amended, below). Compare answers to what your clients/you value. Is there a fit?

• What are the key features of the outsourcer that they value?

• What are the key benefits that the outsourcer gives them?

• What would they say makes the organisation distinctive vs. competitors?

• Ask them to sell you the organisation to you in 30 seconds.

Key consideration: Try and speak to organisations of roughly the same size as your own to get a feel for where they rank in each accountancy outsourcers’ priorities. Will your business get the attention it deserves? Most of Yempo’s clients are small and medium-sized enterprises.

“Ready to offer a helping hand at any time. Yempo’s resource channel is packed with usefulness. Invoices, holiday schedules, interview question guidelines, code of conduct documents; performance management” (Yempo client).

Step 5 – Get cracking! Hire the accountancy skills you need

Pro tip: start with a small team, prove the model and expand.

What are you waiting for? If you’ve found the right accountancy and finance outsourcing partner for your organisation, they can now lead you through the hiring process and get you started on a new journey towards enhanced capabilities and lower costs.

“A one-stop shop from job spec to ad, interview, employment, admin, tech, payroll” (Yempo client).

Read more.

Thank you for visiting our blog! We hope you found our content informative and engaging. Stay connected with us for more insightful blogs, updates, and tips on outsourcing IT & outsourcing Finance in the Philippines, or shoot us an email at [email protected]. We are happy to answer your questions!

Learn more

Find & cost IT & Development talent you need.

Explore your aims with Michelle, our CEO.

Download our Step-by-step IT & Development Outsourcing Guide