- The Philippines based Accountancy and Finance skillsets that others are adding to their teams in 2024.

- Understand market drivers: the ‘heart’, economic, commercial, and technology factors behind the demand for offshore accountancy talent.

- Assess if competitors using offshore talent have an unfair advantage vs. your business.

- Checklist. Is adding offshore accountancy talent right for your business?

“Yempo gives us a dedicated, reliable, consistent team with a great work ethic that’s looked after well.” -Andrea Harris, CFO, Powertech (Yempo Client)

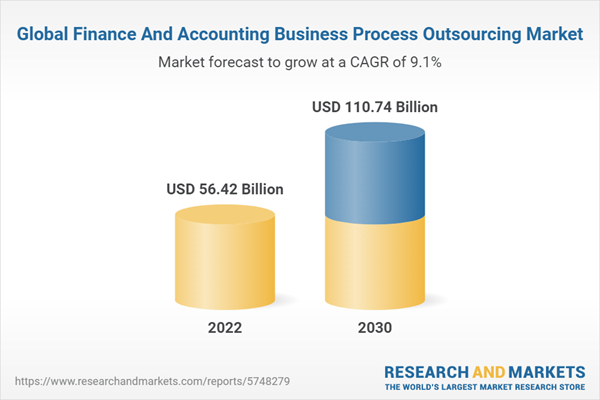

The growth of the accountancy outsourcing market is staggering. So, why should you consider adding offshore accountancy talent to your team?

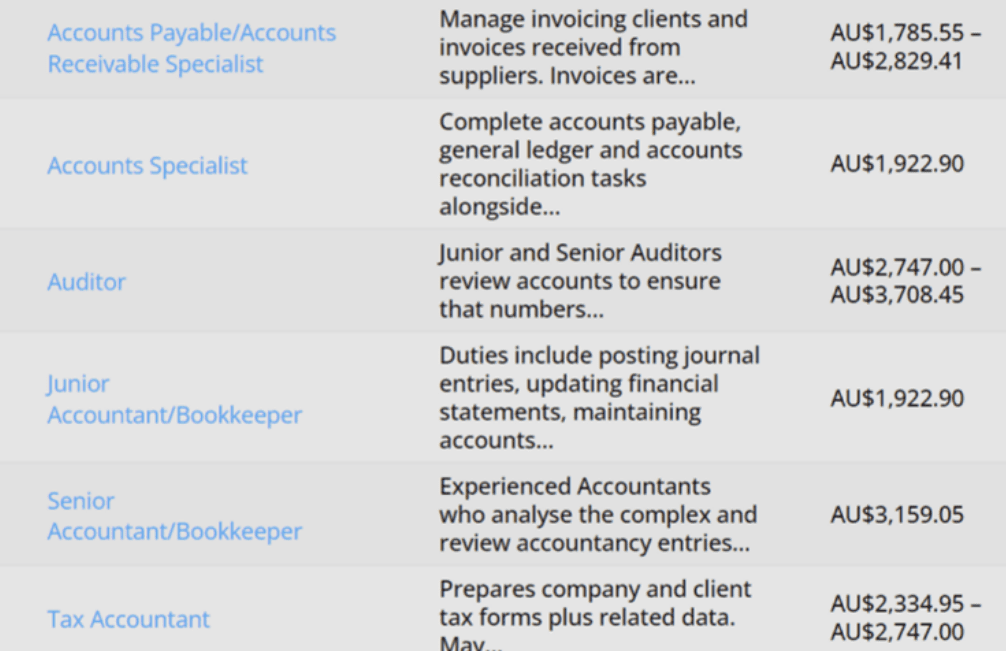

These accountancy skillsets are in high demand by our clients:

- Accounts Payable Specialist

- Accounts Receivable Specialist

- Accounts Specialist

- Senior Accountant / Bookkeeper

- Junior Account / Bookkeeper

- Auditors

- Team Lead Accountant

Are you finding it easy to recruit for these roles?

“Better skills than we can hire locally.” – Chris Gilligan, Compliance Data Lab (Yempo client)

Why you should consider outsourcing these Accountancy Roles in 2024

Are you new to outsourcing? Do you feel confused by the array of remote employee options? Are you worried about managing the process and compliance with local legislation? Or not sure if you need remote employees in the Philippines or somewhere else? Don’t worry, you’re far from alone.

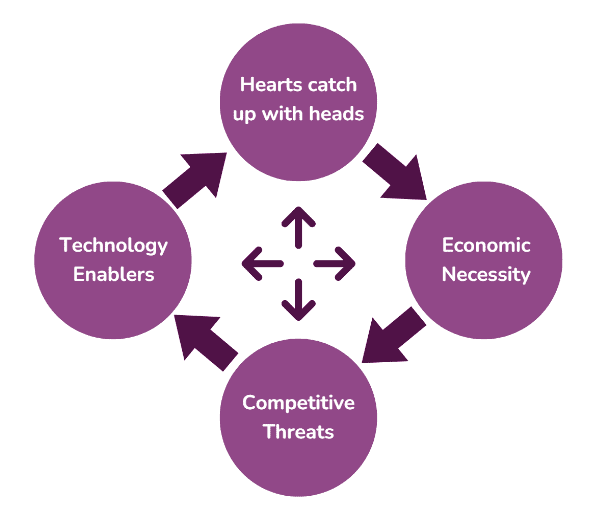

‘Save on salaries’ has long been outsourcers’ rallying cry. Yet, our experience is that decisions to add offshore talent to teams are significantly more complex. After all, it’s long been possible to save salaries via this route. What’s so different now? What’s accelerating demand?

We see four key drivers:

- Hearts catching up with heads

- Economic Necessities

- Competitive Threats

- Technology Enablers

We’ll explain these in more detail. You can then decide which of these apply to your organisation(s).

A shift from ‘feels new’ to ‘new normal’.

We like saving costs. But we don’t like risk. Most of us prefer choices that are certain to give us outcomes we want. We avoid the new, the unfamiliar.

- Will the talent be as good as we can hire locally?

- What will clients think? Colleagues think?

- Will offshore team members be treated well?

- How will we comply with local HR legislation?

“Yempo makes adding offshore talent easy. The team we have (via Yempo) feels like part of our company.” -Russell Khan, Head of People and Culture (Yempo client)

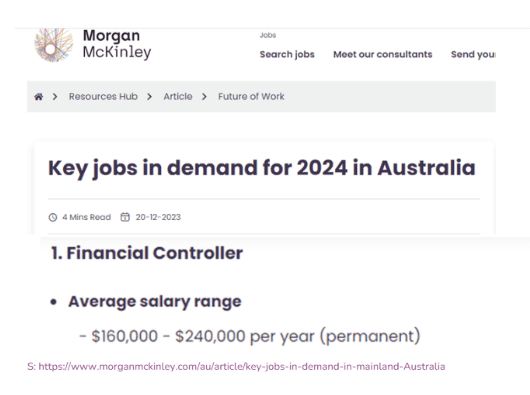

Hiring in-country accountancy talent’s increasingly challenging.

Clients report increasing competition for local accountancy talent. The impacts they’ve shared include:

- Rising salary costs

- Increased staff turnover

- More management time allocated to recruitment

- More management time allocated to training

- Less time for business leaders to focus on growth

“A lower cost base allows us to offer services to clients at reasonable prices: clients get value for money.” -Jacki McAvenna, We Are Lumen (Yempo client)

Can your business win work when others save up to 70% on salary costs?

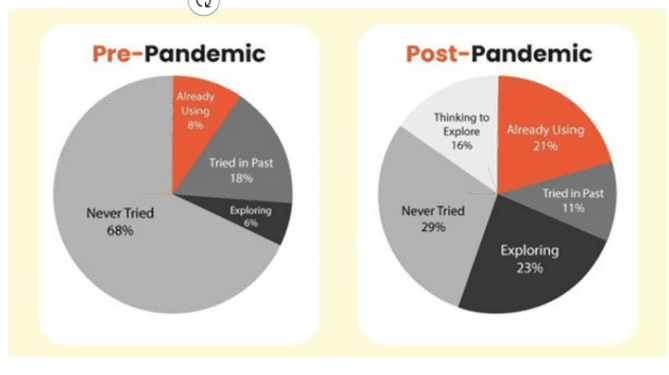

Before the pandemic about 6.2% of the accounting firms used offshore staffing. Today, the number has grown to a whopping 41.3%. The pandemic changed the way accounting firms develop offshore teams.

Winning new work is the lifeblood of business.

Post pandemic, it’s claimed that over 40% of accountancy firms have added offshore talent to their teams. Their salary savings present a clear competitive threat to the remaining 60% of firms that are reliant upon purely local talent.

Most of our clients blend local and offshore accountancy talent. Aside from keeping them competitive, they gain cover for holidays and time zones; unmatched by in-country staff only competitors.

“Our Yempo team means we can provide continuity of service to our clients across public holidays.’’ – Russell Khan, Head of People and Culture (Yempo client)

Shared systems = One team, low risk.

The shift to cloud accountancy systems has changed the game.

‘One team’ working across local and offshore accountancy team members is everyday easy.

- Tools are shared by in-country and remote teams.

- Communications are instant.

- Tasks are simple to allocate & track.

- Performance monitoring is simple

“English skills are excellent. Incoming calls to our Perth number are answered by anyone in our team – Australia and Philippines – and customers can’t tell the difference.”-Andrea Harris, CFO, Powertech (Yempo Client)

Assess if competitors using offshore talent have gained an unfair advantage vs. your business

- Go to Instant Quote Tool, select your currency.

- Input accountancy skillsets you use.

- Compare costs vs. local hires…year one, over three years.

- You’ll know the potential for salary savings.

- You’ll know the potential to add capacity for the same cost(s).

“Our business benefits from significant productivity gains vs. hiring in-country. The Yempo HR team understands what skills we’re hiring for and makes HR processes easy.’’ – Russell Khan, Head of People and Culture (Yempo client)

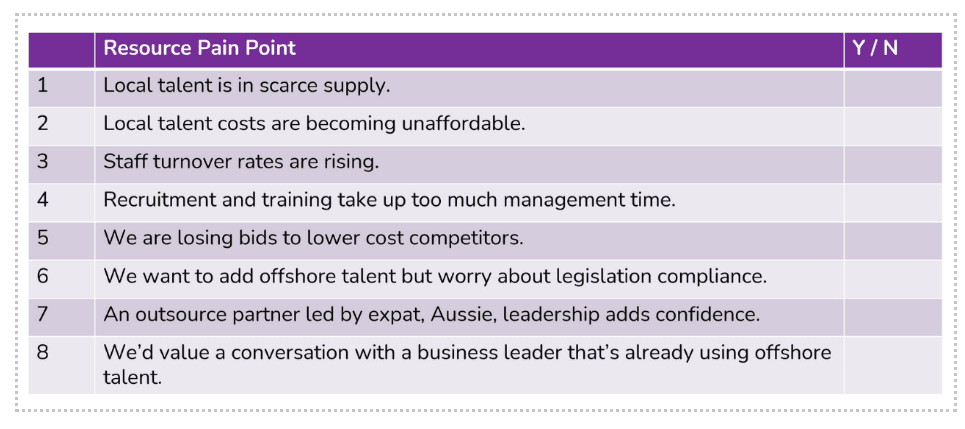

TRY THIS CHECKLIST

Is adding offshore accountancy talent right for your business? If you answer ‘Y’ to more than three questions, then let’s chat.

“Peace of mind. A one stop shop from job spec to ad, interview, employment, admin, tech, payroll.” – Simon Joyce, SDJA Audit Specialists (Yempo client)

Thank you for visiting our blog! We hope you found our content informative and engaging. Stay connected with us for more insightful blogs, updates, and tips on outsourcing IT & outsourcing Finance in the Philippines, or shoot us an email at [email protected]. We are happy to answer your questions!

Learn more

Find & cost Accountancy talent you need.

Explore your aims with Michelle, our CEO.

Download our Step-by-step Accountancy Outsourcing Guide

.